Loan servicing system

With our software, you can focus on your business. We will take care of all your loan company needs with the custom-made system.

With our software, you can focus on your business. We will take care of all your loan company needs with the custom-made system.

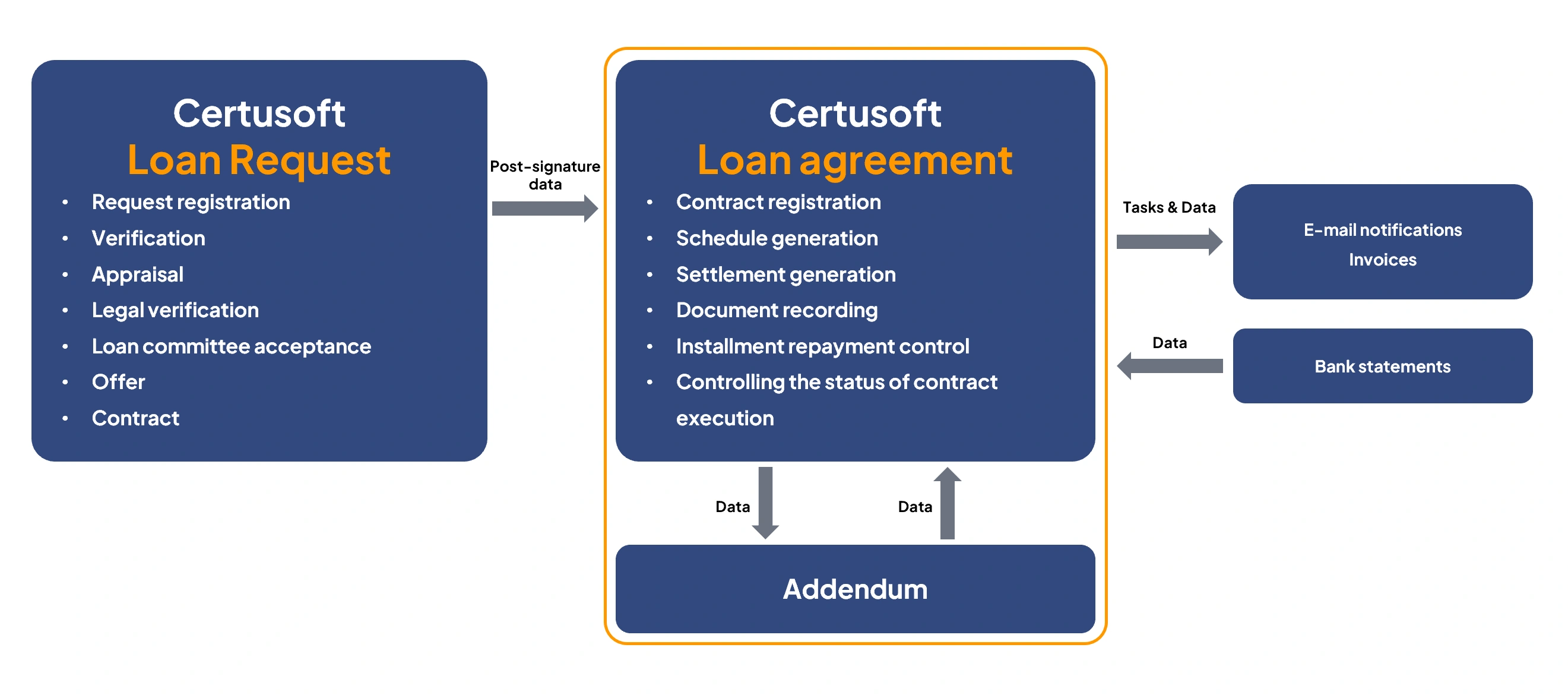

Our loan servicing system comprehensively supports the whole process of granting and settling mortgage-secured loan agreements perform in your company. From the acceptance of the loan application, to the generation of contracts and payment schedules, to the ongoing and final settlement of the entire loan agreement.

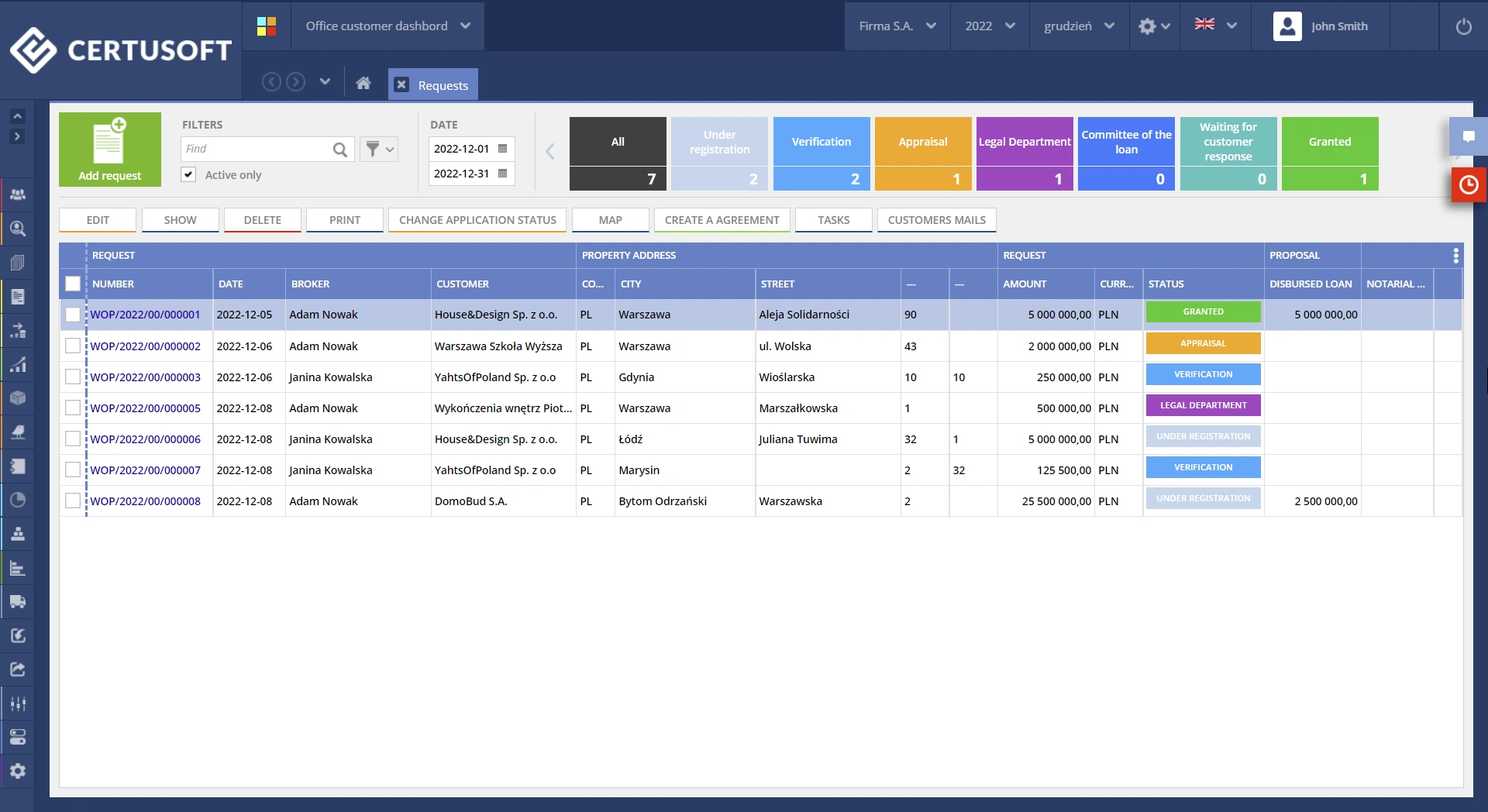

Handling loan application process.

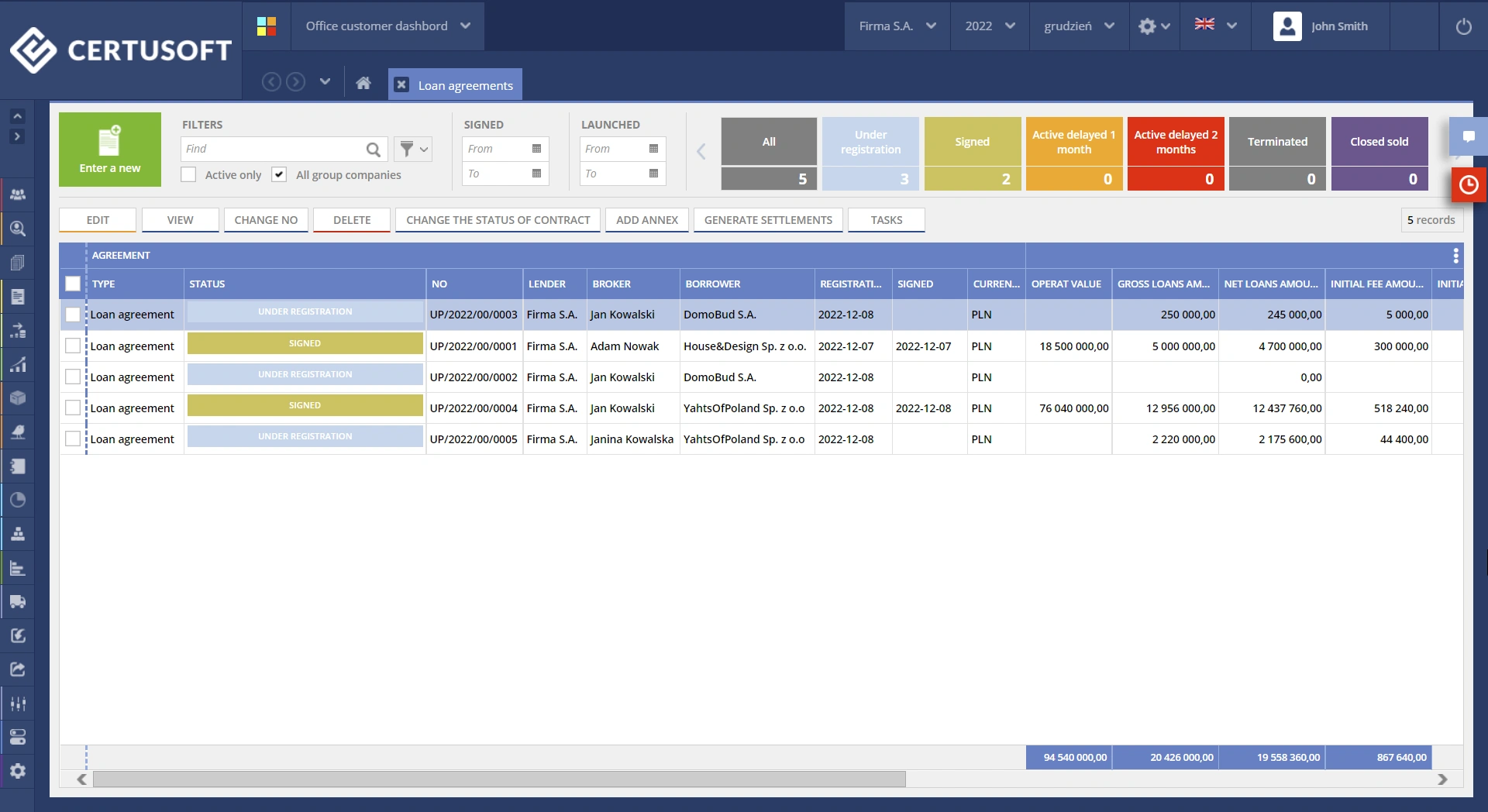

Loan agreements management.

Registry real estate records securing the loan.

Claim Management System.

Manual and automatic notifications.

Loan system that works online.

The loan application can be done in several ways. From the beginning, the entire process can be carried out by an employee directly in our loan servicing software. In addition, applications can also be made by the company's business partners and brokers. The range of functionality is tailored to the permissions the partner receives. Brokers have access to their clients, and their automatically calculated commission by our system depends on the number of successfully signed contracts.

Registration of applications by employees, brokers, and customers.

Cash loan and interest calculator based on defined schemes.

Data records of the collateral property.

Visibility of the property on the map.

Records of documents with their all versions.

Our system handles the process of accepting loan applications submitted independently by customers using a dedicated form on the company website. The customer is guided step by step through the application process and informed of what documents should be attached. The new related record is created in the system in the proper status with all attached documents.

Fully online loan application.

Any number of attachments to the application.

Automatically create positions in the system and assign them to the right broker.

Visibility of the current processing status of the application in the customer's account.

Sending automatic notifications to the customer.

Our solution supports fast loans without unnecessary formalities provided completely online. Software for loan funds allows you to transform an application into a loan agreement. Data between applications and the contract are transferred at the system level which minimizes work. Allows you to handle more loans at the same time which characterizes a good program for loan companies.

Transforming loan applications into loan agreements.

Defined loan types and schemes.

Transfer of loan schedules between proposal and contract.

Records of documentation related to the loan agreement.

Control of the execution of the loan agreement.

Our loan processing system automates the loan settlement process. It allows you to generate payment schedules at the application phase as well as at the contract phase. Our system controls the schedule in an automated way.

Generate payment schedules for loan agreements.

Notifications to customers about loan installment due dates.

Settlement of schedules based on bank statements.

Notifications of non-payment for each installment.

Capability to generate a new schedule for a contract.

Our system creates settlements based on schedules. Elements of the accounting program allow you to download bank statements and automatically tie them to the correct loan installments.

Create settlements based on schedules.

Manual and automatic settlement of loan installment payments based on bank statements.

Notifications to customers about loan installments to be paid.

Automatic calculation of penalty interest and sending of payment notices.

Our software allows you to cast any path for processing a loan application. Likewise for the audit trail of the execution of the loan agreement. Status changes enable automatic reminders before and after the customer's payment due date, reducing business risk in lending.

Faster employee response through automation.

Minimal errors by automating controls.

Automated receivables management.

Our loan company management system supports the control of the execution of each loan agreement through the ability to assign tasks and cases for execution. Tasks are assigned to specific employees, both at the contract life and collection stages. Recording of time consumption, automatic notifications, and supervisor supervision allows you to reduce the costs of the business.

Control of tasks to be performed in conjunction with the loan agreement.

Notifications to employees and supervisors.

Supporting the collection process.

Automatic calculation of commissions for brokers by the system.

Easily create addenda to contracts. Your employees do not need to re-enter documentation. All data will be transferred in conjunction with the contract to which the annex relates. The new schedule will be generated according to the terms adopted in the annex to the loan agreement.

Use your document templates and notifications. Templates for loan applications, loan agreements, calls for payment, and annexes are configured at the system level. Proposing a credit application or a new credit agreement is faster by generating documents based on data from the system.

Personalized sales forms and contracts.

Automatically attach attachments to the loan agreement.

Payment notification templates.

Good loan software allows you to integrate it with your accounting systems. With our software for loan companies, you can issue sales documents that are linked directly to the loan agreement. Thus, record additional loan servicing costs and issue sales documents related to them.

Issuing invoices for services related to loan servicing.

Record cost documents related to the loan agreement.

Automatic settlement of financial documents related to the loan.

BI elements make it possible to analyze the profitability of a loan from the moment the applications are submitted, through the signing of the contract, to any additional costs of servicing the contract resulting from the fulfillment of the claim from the collateral property. The number of annexes and schedule changes do not matter. You know exactly what the profitability is - from the moment of application to the final settlement of the loan.

Our software is a proprietary solution so we offer the ability to customize and expand our system according to the customer's needs. Handling a loan for any purpose secured by a mortgage is the key functionality of Certusoft software. However, our loan company management system can handle loan agreements with collateral records of debt securities and other securities. We fully transfer the process of sales, loan collateral, and collection according to the needs and business objectives of our clients.

More loan processes are conducted at the same time.

The program is easy to use for regular users.

Access to an online loan system for brokers and business partners.

Flexible loan program growing with company needs.

Get a free consultation

Do you have questions about IT systems or would you like to learn more about how to streamline your business and increase sales? Contact us for a free consultation and advice!